NAVLIN Daily NewsCheckout Today’s News

Poland’s Ministry of Health has announced the second reimbursement list of 2026, introducing 16 new therapies, primarily in oncology, while extending funding for hundreds of existing treatments and outlining new legislative tools designed to strengthen the country’s pharmaceutical securityAmong the 16 drugs added to the list are Johnson & Johnson Innovative Medicine’s (J&J) Rybrevant (amivantamab) in combination with carboplatin and pemetrexed for adults with advanced non-small cell lung cancer (NSCLC) with activating epidermal growth factor receptor (EGFR) exon 20 insertion mutations, BMS’ Breyanzi (lisocabtagene maraleucel) for the treatment of lymphoma in adult patients, and Pierre Fabre’s Braftovi (encorafenib) plus Mektovi (binimetinib) for adult patients with NSCLC with the V600E mutation in the BRAF gene“A new trend since January this year is to include the first equivalents of original drugs in the reimbursement scheme to a greater extent. In this announcement, we have introduced five new substances of significant importance to the population,” Deputy Minister of Health Katarzyna Kacperczyk stated, adding “as many as 243 decisions concern the continuation of therapies already covered by reimbursement”

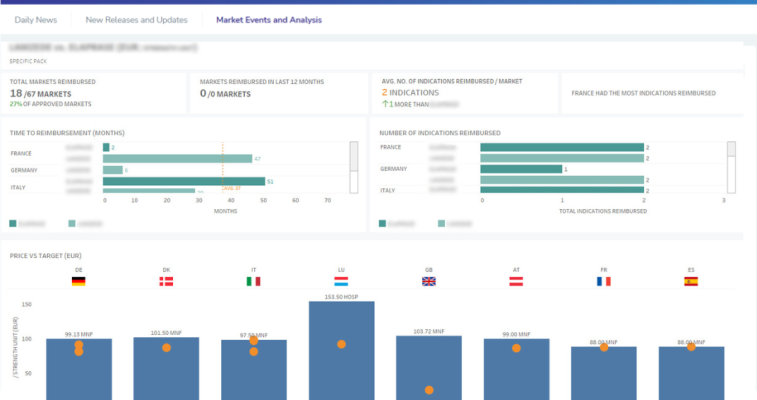

Astellas has reportedly secured a more favourable price for Izervay (avacincaptad pegol) in Japan, after citing Trump’s Most Favored Nation (MFN) policy when negotiating with the authorities. Okamura did say it remains unclear whether Japanese authorities explicitly considered MFN in their deliberations. However, he noted that “The outcome suggests a shift in the government’s stance”The drug carries a U.S. list price of more than USD 2,000 per vial. In Japan, it was set at ¥142,522 (approximately USD 900)Japan is particularly prominent in MFN deliberations, as it is a reference basket country under all three models, GLOBE, GUARD, and GENEROUS

Pharmaceutical companies could lose regulatory market protection in individual EU countries if they fail to make medicines available within three years of a formal request from national authorities, according to the newly released compromise text of the EU’s revised Pharmaceutical Directive“Where within three years after a Member State submitted its request… the marketing authorization holder has not… made the medicinal product available and supplied it continuously… the market protection… shall not apply within that Member State,” the text statesThe European Parliament's Public Health Committee is expected to vote on the final text on March 18. This will be followed by a vote in the plenary session of the European Parliament and the formal adoption of the legislation by the Council of the EU in a few weeks

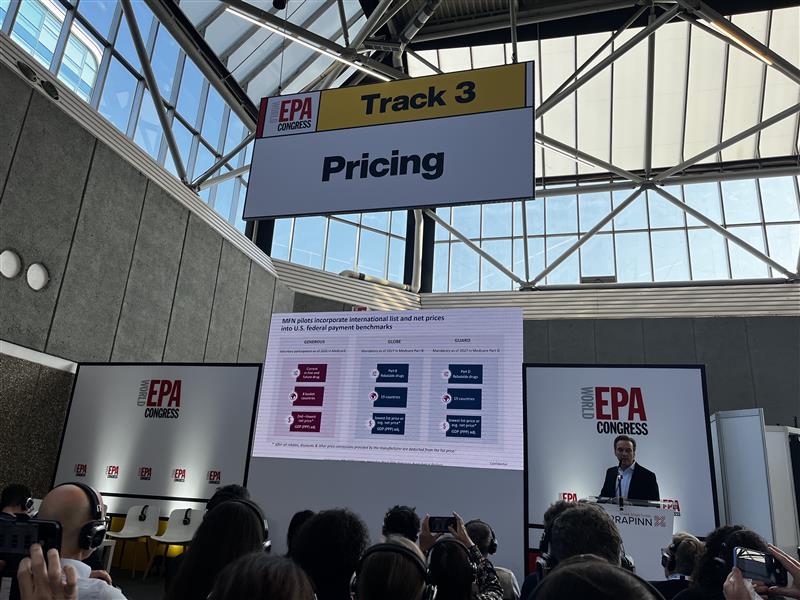

Last week, NAVLIN Daily brought you on-the-ground coverage from the EPA Congress in Amsterdam, alongside major policy developments shaping global drug pricing; from rising U.S.–UK tensions over cost controls, to new disclosures showing some voluntary MFN agreements are limited to three years Pfizer withdrew its EMA marketing authorization application for Zumrad (sasanlimab) in non-muscle invasive bladder cancer, meaning that its Joint Clinical Assessment (JCA) has also been discontinued The U.S. Centers for Medicare & Medicaid Services (CMS) has extended the deadline for drug manufacturers to apply to the voluntary GENEROUS Model; an MFN model that was widely discussed across the EPA congress throughout the week

A panel at the World Evidence, Pricing and Access (EPA) agreed that under Most Favored Nation (MFN), “Launch or no launch [in ex-U.S. markets] becomes a binary decision. If there’s no launch, everybody loses, patients, the healthcare system and the company.”Dierk Neugebauer, VP for market access and government affairs at Bristol Myers Squibb, suggested that markets left unserved by multinational companies could create opportunities for other manufacturers. “China is waiting for something like this,” he said. “If companies decide not to launch in certain markets, others may step into that gap”On top of this, Alan Crowther, general manager at EVERSANA, argued that global pricing is increasingly becoming a “zero-sum game,” while Ulrik Haagen Panton, VP global pricing at Novo Nordisk, suggested “Net price referencing is potentially a dealbreaker" for existing confidential mechanisms

China is rolling out the first eight batches of its centralized procurement round, with contracts active until 2028. Procurement officials are calculating basic quantities, while remaining quantities are allocated by medical institutions to additional suppliers offering prices equal to or below the quotation benchmarksOver 51,000 medical institutions participated in the last procurement round, with 1,091 companies bidding for 4,623 products. The process favored oral solid drugs over injectables and saw strong competition in oncology and chronic disease areas, while specialty drugs drew fewer biddersBig players like Qilu Pharmaceutical excelled, maintaining a win rate above 95%, but hundreds of smaller firms secured just one product. Ambroxol injection led in popularity with 48 suppliers winning bids. Leading manufacturers are likely to grab a larger market share as they ensure stability in supply

Speaking at the World Evidence, Pricing and Access (EPA) Congress in Amsterdam, Sandro Cesaro, Head of Europe Market Access & Pricing at AstraZeneca, encouraged companies to “Act locally, think globally” when launching in the “new world order”While acknowledging that the EU pharma legislation has “a good objective,” Cesaro cautioned that policymakers must avoid introducing conditions that inadvertently undermine incentives for innovationHe warned that the emergence of MFN-type policies could accelerate the trend toward global price interconnectivity, particularly with the proposed net price transparency initiatives that Trump is planning

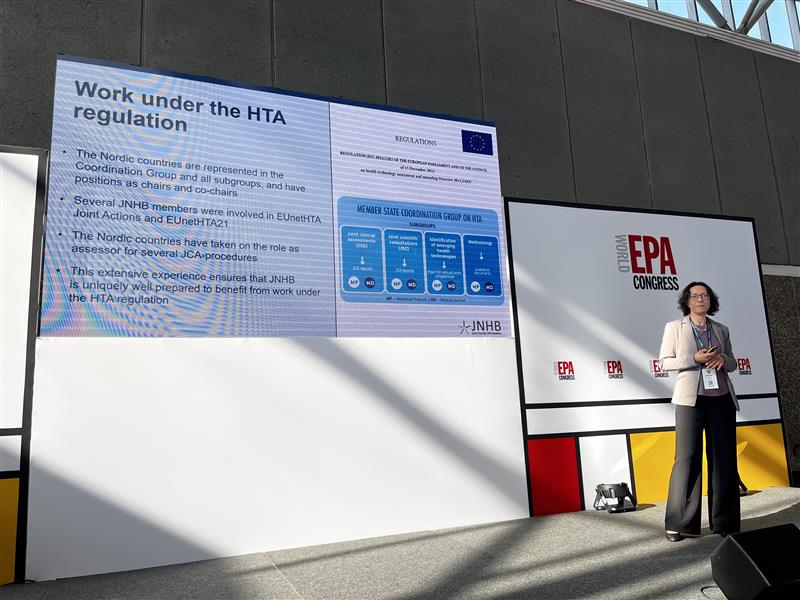

Nordic HTA bodies, which already collaborate extensively, are preparing to integrate Joint Clinical Assessment (JCA) reports into their Nordic-level and national-level assessmentsAt EPA, Maria Eriksson, medical assessor at Sweden's Dental and Pharmaceutical Benefits Agency (TLV), said that Nordic authorities believe they are well prepared for the transition, owing to their longstanding involvement in European HTA cooperation; particularly as several JNHB members were involved in EUnetHTA, and the Nordic countries have already taken on assessor and co-assessor roles in the first wave of JCAsEriksson sees positive outcomes for the Nordics from JCA, including faster timelines (as fast as 90 days), shared resources across countries, aligned processes, and better rare disease assessments. Additionally, early visibility of PICOs will help them identify appropriate products for the region and proactively engage with manufacturers

Speaking at the World Evidence, Pricing and Access (EPA) Congress, Neil Grubert offered delegates a high-level whistlestop tour of global policy changes, akin to his concise and informative LinkedIn presence He acknowledged that the implications of such widespread changes are still unclear. “Europe may offer greater stability,” he suggested, “but the pace of policymaking is slower compared with the increasingly rapid, and volatile, regulatory environment in the U.S.”Interestingly, he argued that China’s accelerating innovation capacity is being overlooked, and that it may actually have the most impactful long-term effects of all global changes

If day one established the themes of disruption and uncertainty, day two reinforced that Most Favored Nation (MFN) is now the single most disruptive force in global market access.. perhaps everSessions across the tracks and auditorium returned repeatedly to the same issue: how companies should navigate an increasingly interconnected (and increasingly volatile) global policy environmentHere are NAVLIN Daily’s key takeaways from day two